There are multiple mainstream Bitcoin narratives and I disagree with all.

- A speculative asset

There's nothing more human than speculating. It comes from latin "speculari" -> "to look out", "to look ahead" and eventually "to foresee or conjecture".

Conjecturing is the way humans learn: we conjecture ideas, criticize them and test them with reality, aka science. Rewarded if right, punished if wrong: then we correct the errors in the way we think. Every asset is consequently speculative, we value them based on our theories of the value it has

- A scam

People that say Bitcoin is a scam argue that the reason it has a price above zero is because holders spread the gospel and others buy the narrative; it's then a ponzi that will last for as long as existing holders manage to bring newcomers

It's "better" than an "speculative asset" but still flawed because as I will explain later on, it's definitely worth holding some

- Money

I bought this idea for a while but money needs to be a unit of account (UoA), i.e. stable over a basket of goods to be the most liquid one (the asset that loses the least value per transaction) and there is no way BTC will be that with an inelastic supply. Let me elaborate below

- Digital gold

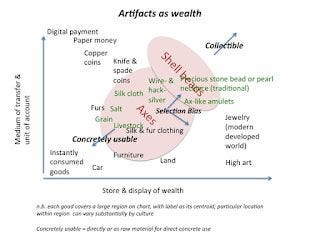

Money is an evolution of primitive proto-moneys (collectibles) that our ancestors used to track favors, as insurance, collateral, inheritance... All these functions Szabo categorizes them as "the institution of wealth transfer".

By being easier to exchange and also by having a centralized entity that manages supply, current forms of money are able to stay stable compared to a basket of goods and become the most liquid asset in an economy in countries with decent rule of law and reputed Central Banks.

In the chart money would be upper left while BTC (collectibles) upper right (but not the top)

The reason gold was the most liquid asset for 1000s of years is because there were no better UoAs

You can't be the most liquid asset without losing purchasing power over time, there's a trade off: assets offer dividends, coupons etc... to offset the lack of liquidity compared to money

The value of BTC that offsets its lack of liquidity and makes it worth holding is its trust minimization, it enables a new institution of digital wealth transfer: for the same reason people still hold gold and jewelry (collectibles) to date: poor rule of law makes it worth holding wealth that is not dependent on laws.

Everything that depends on a 3rd party is risky

Trusted third parties are security holes

Nick Szabo

Cypherpunks wanted to create in cyberspace a realm of freedom and progress which can't happen without cooperation, which can't happen without institutions

In cyberspace institutions like laws don't work, so cypherpunks had to "write code", i.e. build new digital ones to enforce our rights based on those that existed before the first laws emerged 1000s of years ago

While digital gold is the closest, I believe the best definition of Bitcoin is consequently Szabo's "new digital institution or medium of digital wealth transfer"